Historic inflation spikes, international conflict and valuations falling to their lowest point in two years. These were hot topics that shaped discussions at the eighth annual Strategic Investment Symposium last month at the Francis Marion Hotel in Downtown Charleston.

Each year, the School of Business Investment Program hosts its premier event for the financial community including institutional wealth managers, individual investors and managers of endowments, foundations and family offices. More than 200 attendees learned about investment management strategies in today’s ever-evolving financial landscape.

Strategic Investment Symposium Photography by Reese Moore

This year’s itinerary boasted more than 30 distinguished panelists from the financial world including Kristina Hooper, chief global market strategist at Invesco; David Kelly, chief global strategist at J.P. Morgan Asset Management; Jack Ablin, founding partner and chief investment officer at Cresset; John Stoltzfus, managing director and chief investment strategist at Oppenheimer Asset Management; and Larry Adam, chief investment officer at Raymond James.

- Photos by Reese Moore

After a global market outlook followed by an investment strategies panel, three rounds of breakout sessions were held on trending asset management topics including digital finance and cryptos, private equity investing and the power of business culture.

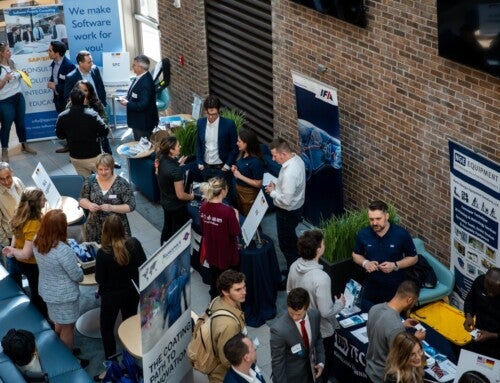

Investment Society students Georges Mahama and Olivia Staff share details about the Investment Program.

In addition to serving as a community event, the symposium highlighted the College’s investment program students and enabled them to network with financial professionals in the region and beyond.

RELATED: Find out more about the Investment Program.

Resulting from a generous donation from College of Charleston parents Steve and Maureen Kerrigan, the Investment Program allows a select group of students to distinguish themselves academically, professionally and personally by managing real money portfolios. Classes are designed to replicate the activities of a real-life investment firm, with each student playing a vital role.